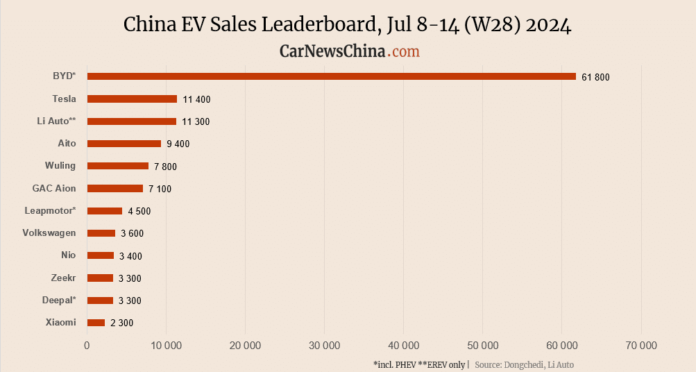

The second week of July was primarily up with several exceptions. Tesla sales grew 75% compared with the week before, BYD was 5% up, and Nio and Xiaomi were down 35%. The NEV market was up 8.8%.

Week 28 of 2024 (W28) is between July 8 and 14. The week W28 of 2023, used for year-on-year comparison, was between July 10 and 16.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China. The data show only passenger vehicles (PVs).

Market situation

3,3A total of 365,000 passenger vehicles were registered in China, up 4.9% from the week before but down 4.9% year-on-year.

NEVs had a 51% market share with 186,000 insured units, up 8.8% from the week before and 35% year-on-year. ICE registrations were 27% down from the previous year.

Automakers

BYD was the first, as usual, with 61,800 registrations, up 5.10% from 58,800 units registred the week before. In the first half of the month, between July 1 – 14, BYD registred 120,600 vehilces in China.

Tesla registred 11,400 EVs, up 75.38% from 6,500 units the week before and 14% up from 10,000 units in the same week the year before.

In the first half of the month, Tesla registred 17,900 EVs in China.

Li Auto registered 11,300 EVs, up 41.25% from 8,000 units the week before and 46.75% up from 7,700 units in the same week the year before. In the first half of the month, Li Auto registered 19,300 EVs in China.

Aito registered 9,400 EVs, up 18.99% from 7,900 units the week before and 944.44% up from 900 units in the same week the year before. In the first half of the month, Aito registered 17,300 EVs in China.

Wuling registered 7,800 EVs, up 16.42% from 6,700 units the week before. In the first half of the month, Wuling registered 14,500 EVs in China.

GAC Aion registered 7,100 EVs, up 4.41% from 6,800 units the week before. In the first half of the month, GAC Aion registered 13,900 EVs in China.

Leapmotor registered 4,500 EVs, up 18.42% from 3,800 units the week before and 73.08% up from 2,600 units in the same week the year before. In the first half of the month, Leapmotor registered 8,300 EVs in China.

Volkswagen registered 3,600 EVs.

Nio registered 3,400 EVs, down 35.85% from 5,300 units the week before and 12.82% down from 3,900 units in the same week the year before. In the first half of the month, Nio registered 8,700 EVs in China.

Zeekr registered 3,300 EVs, down 13.16% from 3,800 units the week before and 43.48% up from 2,300 units in the same week the year before. In the first half of the month, Zeekr registered 7,100 EVs in China.

Deepal registered 3,300 EVs, down 2.94% from 3,400 units the week before and 26.92% up from 2,600 units in the same week the year before. In the first half of the month, Deepal registered 6,700 EVs in China.

Xiaomi registered 2,300 EVs, down 37.84% from 3,700 units the week before. In the first half of the month, Xiaomi registered 6,000 EVs in China.

Denza registered 1,900 EVs, up 11.76% from 1,700 units the week before and 24.00% down from 2,500 units in the same week the year before. In the first half of the month, Denza registered 3,600 EVs in China.

Xpeng registered 1,700 EVs, down 5.56% from 1,800 units the week before and 19.05% down from 2,100 units in the same week the year before. In the first half of the month, Xpeng registered 3,500 EVs in China.