In the third week of August, week 34 of the year, the market was firmly up, with Zeekr and Xiaomi being the exceptions. Nio’s insurance registrations were up 40%, and BYD was up 10% compared with the week before. Tesla was mainly flat, and Xioami was 20% down.

Week 34 of 2024 (W34) 2024 is between August 19 – 25. The week W34 2023, used for year-on-year comparison, was between August 21 – 27.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

NEV penetration exceeds 50% again

The EV market in China continues to grow in W34, with the weekly penetration rate exceeding 51% once again. In W34, total vehicle sales reached 467,000 units, representing a slight year-over-year decrease of 0.43% but a significant week-over-week increase of 13.08%. ICE vehicle sales totaled 226,000 units, a year-over-year decline of 24.41%, though a 14.72% increase was noted from the previous week. Meanwhile, NEV sales surged to 241,000 units, marking a 45.18% increase from the same period last year and an 11.57% rise from the previous week. The NEV penetration rate for the week stood at 51.61%, a significant jump of 16.21%compared to last year.

Year-to-date, the Chinese automotive market has seen total sales of 13.053 million units, reflecting a year-over-year growth of 3.22%. ICE vehicle sales, however, have declined to 7.343 million units, down 14.02% from last year. On the other hand, NEV sales have continued to climb, reaching 5.71 million units, a notable 39.09% year-over-year increase. The year-to-date NEV penetration rate has risen to 43.74%, up by 11.28 percentage points compared to the same period in 2023.

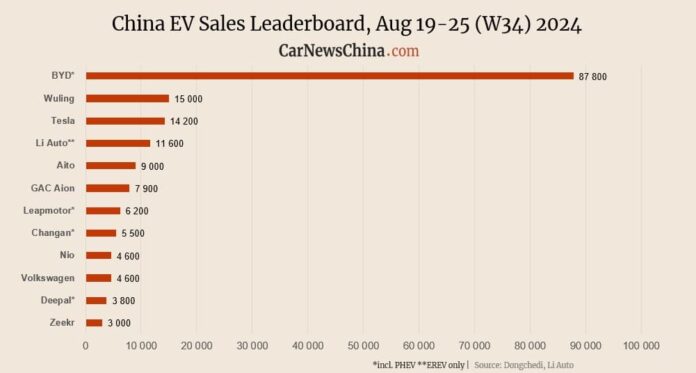

Brand registrations

BYD secured the top position, registering 87,800 vehicles, its weekly ATH record. It is up 11.85% from 78,500 the week before and up 69.83% from 51,700 units in the same week last year.

So far, between August 5 and 25, BYD has sold 242,100 vehicles in China.

GM’s Chinese joint venture SGMW sold 15,000 EVs under the Wuling brand, up 18.11% from 12,700 units the week before and 92.31% from 7,800 units the week before.

Tesla secured the third position, registering 14,200 vehicles, down 0,7% from 14,100 units the week before but down 16.47% from 17,000 units last year. In the first three weeks of August, between August 5 – 25, Tesla sold 44,000 vehicles in China.

Li Auto saw a steady increase, delivering 11,600 vehicles, an 8.41% rise from 10,700 units the week before. Compared to the same period last year, when 7,700 vehicles were delivered, sales grew by 50.65%. For August so far, Li Auto’s sales stand at 33,400 units.

Aito experienced a sharp rise, registering 9,000 vehicles sold, a 60.71% increase from the previous week’s 5,600 units. Year-over-year, sales skyrocketed by an impressive 1025%, compared to just 800 units in the same period last year. In the first three weeks of August, Aito has sold 18,500 vehicles.

GAC Aion recorded sales of 7,900 vehicles, reflecting a 14.49% increase from 6,900 units the week prior. However, on a yearly basis, sales declined by 36.29%, down from 12,400 units. In total, GAC Aion has delivered 14,800 vehicles so far this month.

Leapmotor achieved sales of 6,200 vehicles, a 16.98% growth from the 5,300 units sold the previous week. Year-over-year, this represents a 100% increase from 3,100 units last year. Cumulative sales for Leapmotor in August reached 16,900 units.

Changan managed to sell 5,500 vehicles, slightly up by 5.77% compared to 5,200 units in the previous week. Year-on-year data is unavailable for comparison, but this August, Changan has delivered 14,800 vehicles.

Nio saw a notable jump, with 4,600 vehicles sold, representing a 39.39% increase from the 3,300 units sold the previous week. However, compared to last year’s 5,000 units, sales are down by 8%. Cumulative sales for August so far stand at 11,200 units.

Volkswagen recorded sales of 4,600 vehicles, a 21.05% increase from the 3,800 units sold the week prior. Compared to last year’s 4,900 units, this marks a slight decline of 6.12%.

Deepal reported 3,800 vehicles sold, reflecting a 22.58% growth from the 3,100 units sold the previous week. On a yearly basis, sales grew by 31.03%, up from 2,900 units last year. Cumulative sales in August have reached 9,600 units.

Zeekr delivered 3,000 vehicles, down 14.29% from the 3,500 units sold the previous week and a slight 3.23% decrease from 3,100 units last year. So far in August, Zeekr has sold 9,900 vehicles.

Xpeng saw an increase, registering 2,800 vehicles, up 21.74% from the 2,300 units sold last week. However, compared to the previous year’s 3,300 units, this represents a 15.15% decline.

Xiaomi experienced a drop in sales, delivering 2,100 vehicles, down 19.23% from the 2,600 units sold the previous week. There is no data available for last year’s performance. Xiaomi’s cumulative sales for August stand at 8,200 units.

Denza reported sales of 1,800 vehicles, a 5.88% increase from the 1,700 units sold last week. However, this represents a decline of 21.74% compared to 2,300 units last year. So far in August, Denza has sold 5,300 vehicles.