Next-gen Ford EVs will be simplified and have batteries built in-house to keep costs down.

Ford has several new EVs in the pipeline including a new midsize electric pickup truck where it claims its engineers have “overdelivered.”

Like many automakers these days, Ford is backtracking on its plans to go fully electric by the end of the decade.

Even though Ford’s F-150 Lightning sales more than doubled in the third quarter of 2024 and even went up 86% year-over-year, the Blue Oval’s EV division is still many billions in the red, according to the recently released Q3 earnings report. While the company’s EVs are doing better (especially the Lightning), Ford adjusted projections down after Q3.

One big, persistent challenge: getting the costs of both EVs and their batteries down to where they can actually be sold profitably. Outside of Tesla, which took years to pull that off, that’s proving to be a complex and difficult task for the entire auto industry. And it’s a big problem when the only thing holding back a potential influx of cheap Chinese EVs is tariffs.

So on Q3’s earnings call, CEO Jim Farley said Ford’s upcoming electric midsize truck has a lofty goal: match what China can do with its EV manufacturing costs. And that means simplify, simplify and simplify some more.

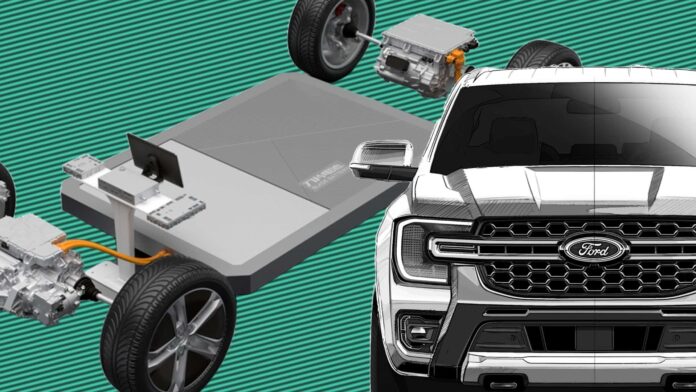

We already know Ford is working on a new affordable EV platform to underpin its future electric models after the manufacturer officially announced it in February. This new platform promises to not only allow the manufacturer to sell EVs at a lower price (starting around $25,000) but it is expected to also offer improved efficiency and superior range to today’s models. The first model to feature this new platform is a new midsize pickup.

Ford CEO Jim Farley, who just can’t get enough of the Xiaomi SU7, recently shed some more light on the new pickup, which he said will “match the cost structure of Chinese OEMs building in Mexico,” allowing the Blue Oval to be even more competitive than it is today. Farley also noted that the team developing the new platform has “overdelivered,” but he didn’t say in which area.

“In 40 years in the industry, I’ve seen a lot of game-changer products,” Farley said on the call. “But the midsized electric pickup designed by our California team has got to be one of the most exciting. It’s an incredible package in consumer technology for a segment we know well. It matches the cost structure of any Chinese auto manufacturer building in Mexico in the future. How do we know that? Because 60% of the (parts and components needed) have already been quoted.”

Ford recently pushed back some of its EV plans amid uneven demand and as it focuses on cost control. A planned electric three-row SUV was scrapped and will become a hybrid instead. Still, it has at least two known EV trucks supposedly still in the works: “Project T3,” set to launch in the second half of 2027 and billed as a likely sort of F-150 Lightning successor, and that “skunkworks” truck project developed by a team in California. That truck was also recently revealed to be a midsize one instead of a compact one as initially expected. T3 didn’t come up on the call, so Farley was referencing the midsize project. That clearly took inspiration from China’s automakers, Farley said.

“That has been an eye-opening experience for us to see what really should cost on a lot of these advanced components, especially because we think companies like BYD have an incredible advantage on (the) affordability of batteries,” Farley said. “So, we have to make that up where our opportunity is on the EV component side, inverters, gearboxes, motors, etc.”

He added, “We have a unit casting strategy that massively simplifies the stamping of the vehicle. I think a lot of other companies will do that. But what I’m really seeing is an ethos of simplicity and a higher engagement with a broader supply chain earlier in the process than the typical Ford development cycle.”

Ford is currently building a battery factory in Michigan, which will manufacture lithium iron phosphate (LFP) batteries starting in 2026. It will attempt to emulate the successful strategies of Chinese EV manufacturers by fully controlling its own battery supply chain. However, it is unlikely that it will be able to produce batteries at a lower cost than those made in China.

Making as many components in-house as possible, thus having more control over the supply chain, is another way Chinese automakers are able to cut costs, speed up the implementation of changes and pass the savings on to buyers.

Another way Ford wants to keep costs down is by simplifying its vehicles. Farley explains that “the number of parts in the vehicle is an order of magnitude change. When you simplify the components to that level, and you really move the design, and supplier design phases earlier, you can integrate simpler design with better costs.”

In Europe, Ford offers two vehicles built by Volkswagen on its MEB platform, the Explorer and the Capri. It cut costs this way and got the vehicles to market quicker, but it has since announced that it will be scaling back its partnership with VW and focus on delivering vehicles built with its own technology.

Even though the manufacturer remains committed to electrification, Ford is one of many automakers that have voiced concerns over the feasibility of the European Union’s proposed 2035 combustion vehicle ban.

A few months ago, the UK’s Autocar reported that Ford had reconsidered its plan to go all-electric by 2030, quoting Marin Gjaja, the boss of Ford’s Model E electrification division, as saying, “I don’t think we can go all in on anything until our customers decide they’re all in, and that’s progressing at different rates around the world. We don’t see that going all-electric by 2030 is a good choice for our business or, especially, for our customers.” He concluded that the goal was “too ambitious.”

Still, Ford has seen impressive success with hybrids as of late. And from Farley’s remarks, it could be an open question as to whether the “skunkworks” midsize truck could hedge that way, too. “I think that has encouraged us to put hybrid across a whole lineup and be more curious about other partial electric solutions, which we’ll talk to you about,” he said. “I would say the skunkworks team has over-delivered, at least in the design of the platform. Now, we have to make it to high-scale production.”