In the last week of November, the week 48 of the year, China EV market was mostly up, with Wuling being an exception. Xiaomi was up 37%, Tesla 12%, Nio grew 2.5%, and BYD 2% compared with the previous week.

The week 48 of the year was between November 25 and December 1. The week 48 of 2023 used for YoY comparison was between November 28 – December 3.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China. Onvo registrations are not published by Li Auto but come from China EV DataTracker.

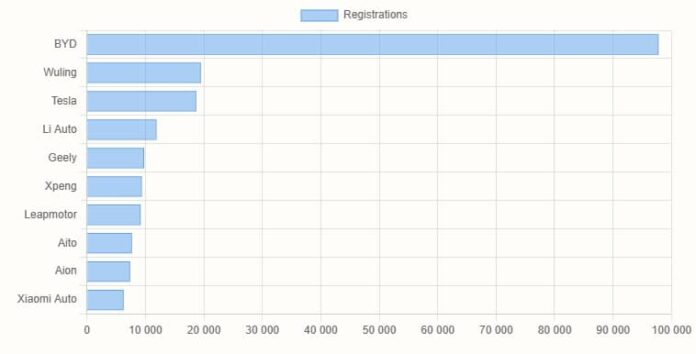

BYD registered 97,800 vehicles, marking a 2.0% increase from the previous week. Year-over-year, BYD’s registrations surged by 74.0%.

In 2024 (Jan-Nov), the company sold 3,740,930 passenger EVs, up 40% from the same period last. BYD sells both BEVs and PHEVs, in 2024 the sales ration is 42% for BEVs and 58% for PHEVs.

Wuling registered 19,500 vehicles, reflecting a 5.3% decrease from the previous week. Year-over-year, Wuling’s registrations grew by 58.5%.

Tesla registered 18,700 vehicles, a 12.0% increase from the previous week. Year-over-year, Tesla’s registrations rose by 6.2%.

Li Auto registered 11,900 vehicles, marking a 2.6% increase from the previous week. Year-over-year, Li Auto’s registrations grew by 24.0%.

In 2024 (January – November), Li Auto delivered 441,995 EVs, up 35.7% from the same period last year.

Geely brand registered 9,800 vehicles, reflecting a 12.6% increase from the previous week.

Volkswagen-backed Xpeng registered 9,400 vehicles, marking a 30.6% increase from the previous week. Year-over-year, Xpeng’s registrations soared by 95.8%.

The data include Xpeng’s Mona series (it’s not a separate brand). Xpeng sells the sole car, the M03 sedan, under the Mona series, which registered 4445 units in week 48, according to China EV DataTracker.

Stellantis-backed Leapmotor registered 9,200 vehicles, a 1.1% increase from the previous week. Year-over-year, Leapmotor’s registrations surged by 114.0%.

Aito registered 7,700 vehicles, reflecting a 2.7% increase from the previous week.

GAC Aion registered 7,400 vehicles, marking a 4.2% increase from the previous week. Year-over-year, Aion’s registrations declined by 8.6%.

Xiaomi Auto registered 6,300 vehicles, reflecting a 37.0% increase from the previous week. Year-over-year data for Xiaomi Auto is not available as Xiaomi launched its first EV on March 28.

Xiaomi cumulative sales reached 112,516 EVs in November, according to data monitored by China EV DataTracker.

Deepal registered 6,300 vehicles, a 3.3% increase from the previous week. Year-over-year, Deepal’s registrations rose by 117.2%.

Zeekr registered 6,200 vehicles, reflecting no change from the previous week. Year-over-year, Zeekr’s registrations surged by 113.8%.

In 2024 (January – November), Zeekr delivered 194,933 EVs, up 85.5% from the same period last year.

Nio brand registered 4,100 vehicles, marking a 2.5% increase from the previous week. Year-over-year, Nio’s registrations grew by 10.8%.

Insurance registration numbers include only the registrations of the Nio brand, not the Onvo. The Onvo registered 1825 units of its only model L60 SUV in week 48.

In 2024 (January – November), Nio company delivered 190,832 EVs, up 34.4% from the same period last year, including about 10k Onvo cars.

ArcFox registered 3,100 vehicles, reflecting a 10.7% increase from the previous week.