In the first week of December, week 49 of the year, China’s EV market was mainly down, with several exceptions. Xiaomi was down 14%, BYD was down 13%, Nio was down 10%, and Tesla was up 17% compared with the previous week.

Week 49 (W49) of the year was between Dec 2 and Dec 8. Week 49 of 2023, used for year-on-year comparison, was between Dec 4 and Dec 1.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China. Onvo registrations are not published by Li Auto but come from China EV DataTracker.

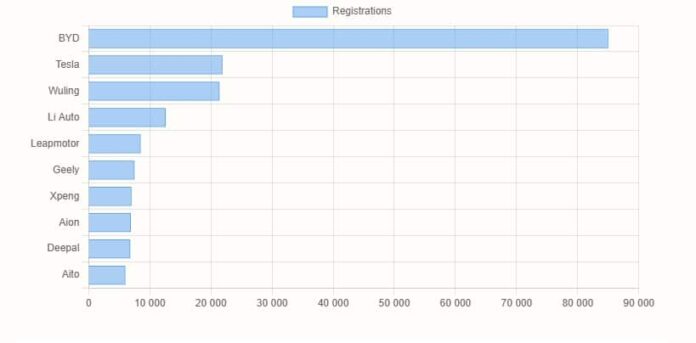

BYD maintained its leading position with 85,000 registrations, a 13.1% decline compared to the previous week. Year-over-year, BYD’s registrations rose by 79.3%.

In 2024 (Jan-Nov), the company sold 3,740,930 passenger EVs, up 40% from last year. BYD sells both BEVs and PHEVs: in 2024, the sales ratio is 42% for BEVs and 58% for PHEVs.

Tesla recorded 21,900 registrations, marking a 17.1% week-over-week increase and a 42.2% rise from the same period last year.

For Tesla, this was the third-best week in its history in China, after it registered 23,109 EVs in week 39 of 2022 and 22,600 in week 39 of this year.

Wuling registered 21,400 units, up 9.7% from last week and showing a robust 101.9% growth year-over-year.

Li Auto achieved 12,600 registrations, an increase of 5.9% from the previous week and a 21.2% growth compared to last year.

Leapmotor registered 8,500 vehicles, a 7.6% drop from last week. However, year-over-year registrations surged by 129.7%.

Geely saw 7,500 registrations, down 23.5% week-over-week.

Xpeng registered 7,000 units, a week-over-week decline of 25.5%. Year-over-year registrations jumped by an impressive 169.2%.

Aion recorded 6,900 registrations, down 6.8% week-over-week and a 19.8% drop year-over-year.

Deepal registered 6,800 units, an increase of 7.9% from last week and a substantial 151.9% rise compared to the previous year.

Aito reported 6,000 registrations, a 22.1% decline from the previous week. Year-over-year data is unavailable.

Zeekr recorded 5,400 registrations, a 12.9% drop week-over-week. However, this represents an impressive 184.2% increase compared to last year.

Xiaomi Auto saw 5,400 registrations, a decline of 14.3% week-over-week.

Nio registered 3,700 vehicles, a 9.8% decline from the previous week and a 27.6% increase compared to last year.

Li Auto does not share Onvo registrations as they are too low, but according to China EV DataTracker, Onvo registered 1,400 units of L60 SUV in week 49, down 23.3% from the previous week.

Notably, Huawei brands are getting traction in China. Aside from Aito, two new brands from Huawei’s HIMA alliance started to appear often in the Li Auto list. Luxeed registered 3,300 EVs last week, up 6.5% form the week before, while Avatr registered 2,400 EVs.