After releasing its results for the first nine months of the year, Volkswagen’s CFO said EV orders are down 50% in Europe. VW’s order intake fell short, attributed to a slowdown in the overall market.

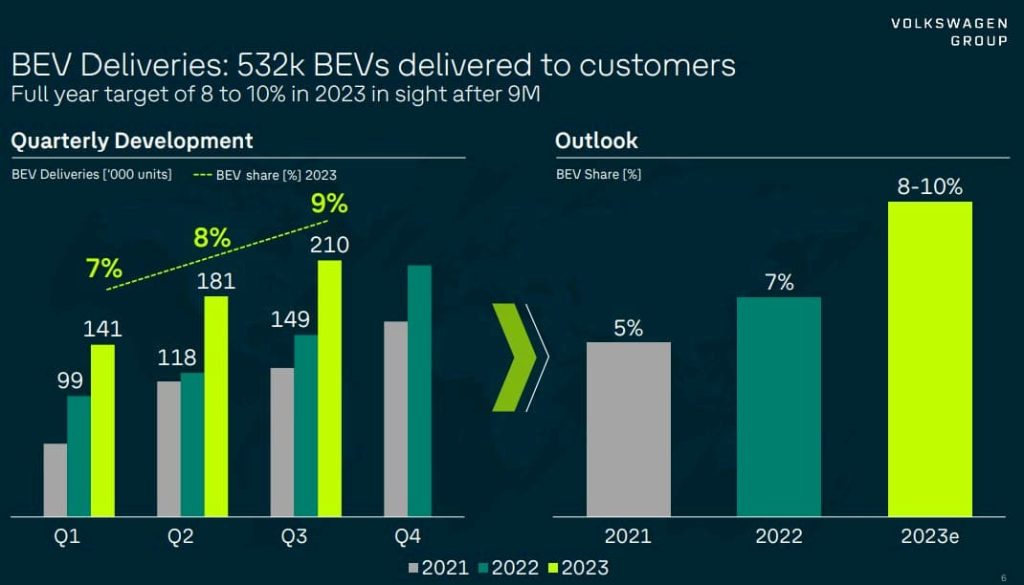

The Volkswagen Group announced Thursday that EV deliveries increased by 45% YOY, reaching 531,500 in the first nine months of the year.

VW’s EV sales share stood at 9% in the third quarter for a total of 7.9% through September. The company said it remains on track to hit its (previously lowered) annual target of 8-10%.

Europe was Volkswagen’s biggest EV market, accounting for over 341,000 electric models (+61%) sold through September. China, the automaker’s biggest market in terms of profits, was next with 117,100 models sold (+4%). EV deliveries in the US rose 74% to 50,300.

Meanwhile, Volkswagen CFO and COO Arno Antlitz explained on a media call that EV orders in Europe are down to 150,000. That’s 50% lower than last year’s total of 300,000.

Europe accounts for over 64% of Volkswagen’s EV deliveries so far this year. Although deliveries grew slightly in China, Antlitz said the company could lose EV market share until new models built with XPeng begin rolling out.

Volkswagen EV orders fall in Europe

Despite EV orders falling significantly from last year in Europe, Volkswagen began seeing intake pick up in the third quarter.

Antiliz said although order intake was below targets, delivery momentum was expected to continue. He attributed the lower demand to the overall market trend.

Hildegard Wortmann, who oversees VW’s marketing and sales, explained earlier this month, “Our order intake is below our ambitious targets due to the lower-than-expected overall market trend.”

The VW spokesperson attributed the third-quarter growth to a high backlog waiting to be processed. He said that supply chain and logistics kinks are being smoothed out, leading to shortened delivery times.

Volkswagen lowered guidance earlier this year from 11% EV sales share to 8-10%. The automaker’s struggles led to production cuts in Germany last month over slowing demand.

The company hopes the “refreshed” ID.4 and ID.5, VW’s top-selling EVs, will help turn things around. The new models come with a new electric drive and battery, providing more range in addition to a modern infotainment.

Volkswagen also launched its flagship ID.7, which has been available to order for weeks now. The new electric sedan starts at around $62,000 (€56,995) with up to 385 miles (621 km) WLTC range.

Electrek’s Take

Several automakers, including Ford and GM, recently announced they would be delaying key parts of their EV rollouts.

GM is delaying Equinox, Silverado RST, and GMC Sierra EV production to “protect pricing.” Meanwhile, Ford is pushing back its 600,000 EV run rate goal until next year. The moves come amid higher interest rates globally and lower-than-expected demand for some EV models.

Meanwhile, other automakers, including Hyundai and Volvo, are sticking to their targets. Both automakers expect the EV momentum to continue with new models rolling out across various segments.

Although EV orders are down in Europe, Volkswagen said they began to pick up in the third quarter as new models hit the market.

Although near-term uncertainty is causing some automakers to abandon their EV plans, others are doubling down. Electric vehicles will continue gathering momentum into the end of the decade, and those making the effort now will be the ones reaping the rewards.

As China, the largest EV market globally has shown, the transition can happen quickly, leaving those unprepared behind.