The Korean battery giant LG Energy Solution supplies a lot of power to a lot of electric vehicles. But these days, the company’s North American president and chief strategy officer, Bob Lee, has steamships on his mind.

“Pretend it’s 1875,” Lee told InsideEVs at the New York Auto Show last week. “Sailboats have been crossing the Atlantic for a couple of centuries. Years earlier, the first steamships crossed, and they’d take longer than the sailships. But the writing is on the wall. Nobody is investing in better sails.”

Lee said that nautical metaphor is one he’s been touting a lot lately, as the automotive industry struggles with its own steamship moment: electrification. Many car companies are slowing down their once-aggressive electric-vehicle goals as sales continue to grow, but not at the warp-speed pace they predicted.

Meanwhile, the United States—the world’s second-largest car market—is now hitting reverse on its previous climate goals, its investments in clean energy and its policies that were both pushing and supporting a mostly-electric future for its car sector.

LG Chem to Establish Largest Cathode Plant in US (in Tennessee) for EV Batteries

It’s a tough time to be in the battery business. But Lee warns that backtracking too much will simply mean that the U.S. and its automotive industry will simply be left behind by new players who figure out how to make this technology cheaper and better.

If the U.S. does go down such a path, “We lose the auto industry,” said Lee, a longtime technology executive with two decades’ experience in the battery space.

“If [America] decides not to do EVs, if we decide we’re going back to internal combustion, and the rest of the world is moving on to cleaner things, what is the rest of the world going to buy?,” he said. “If we’re not the ones out there investing and building that next technology, then I think the risk is serious.”

To be clear, a slowdown in the EV sector is a serious risk to LG Energy Solution’s bottom line, too. The company supplies batteries to a variety of automakers in the U.S., including General Motors, Honda, Hyundai Motor Group and Toyota. The company has bet big on this, and any pullback will hurt it.

Lee said that LG has eight planned battery plants in North America, seven of which are in the U.S. Three are currently producing batteries. It has slowed down on some investments, temporarily pausing an Arizona plant last summer. But the company is also buying out GM’s stake in what was to be a joint venture plant in Michigan once called Ultium Cells LLC.

“There are two plants that are going into production within the next year, and then we have three that’s probably the following year after that,” Lee said. “We’re working very closely with our customers to ramp up production in a very smart way, so that we’re not overextending ourselves.”

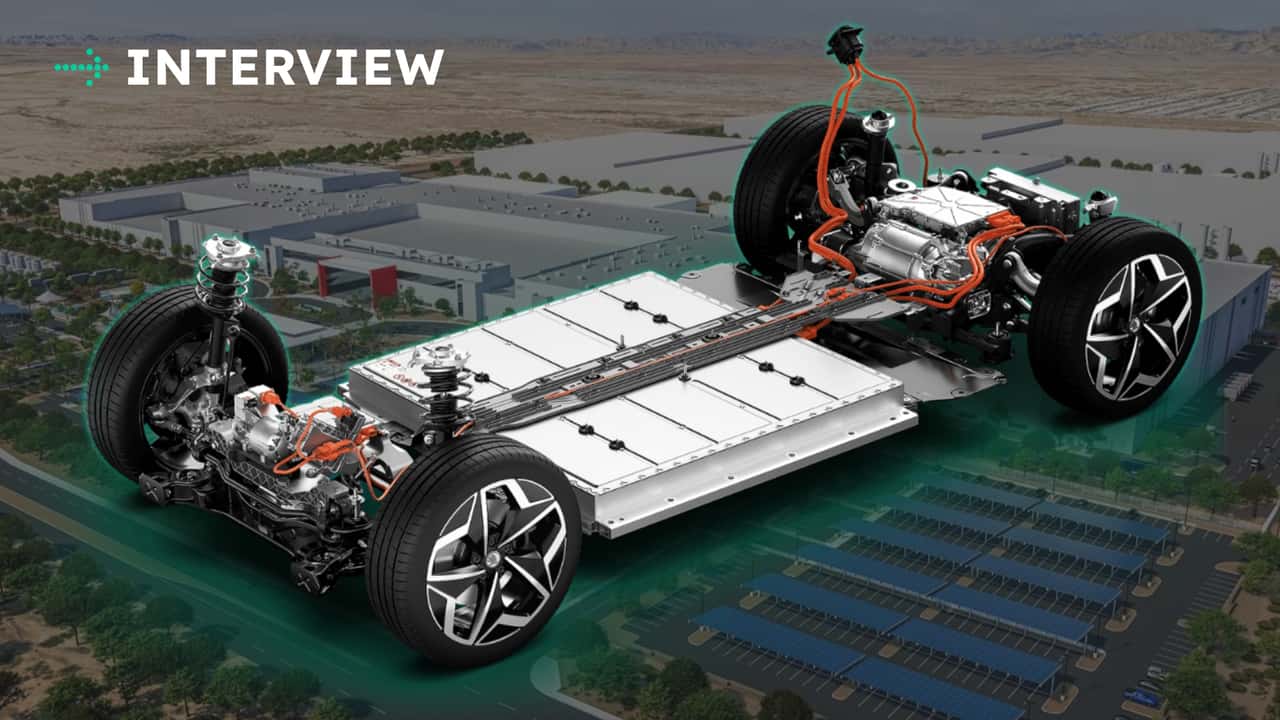

LG Energy Solution batteries

Avoiding that outcome does depend on EV demand, which itself depends on a lot of other factors. Right now, President Donald Trump’s administration is reversing most of the pro-EV policies of his predecessor, Joe Biden. That includes seeking an end to the EV tax credits, cutting investments in charging infrastructure and rolling back fuel economy and emissions rules that were pushing the auto industry to go more electric.

And that’s all before the tariffs, which Lee said “kind of hit everything” in the entire sector. In March, Lee told The Detroit News that those, too, will affect the timelines of battery plant investments. (“Overall, the auto industry right now is not in a position to make big investment decisions,” he told the newspaper.)

Lee told InsideEVs that gutting the Inflation Reduction Act, Biden’s signature climate investment legislation, “is going to potentially impact us,” and so LG is talking to both the Trump White House and members of Congress to “influence that discussion the right way.”

In doing so, LG will join a slew of automakers and elected officials looking to protect billions in EV-related investments and tens of thousands of jobs across America, primarily in red and purple states. At the grand opening of Hyundai’s new EV plant near Savannah, Georgia, one GOP congressman also told InsideEVs he hoped not to see the EV tax credit system get completely gutted.

But Lee also noted that investments in battery plants don’t have to be part of partisan politics; after all, Lee said, LG opened its first U.S. battery plant in 2011 under the Obama administration and announced many more projects during Trump’s first term.

“The overall focus on trying to produce here in the U.S. We agree with that, right?” Lee said. “I think having less dependency on China, we agree with that. So actually, you know, as far as the Trump administration, it’s not like we are against any of their aspirations.

“If we put out faster [EVs] that are cheaper and that last longer, then there’s going to be a natural transition,” he added. “This is really the primary focus for us right now, trying to get to more affordable vehicles. We’re working on new chemistries, new formats to really try to drive down battery prices.”

But with the White House now focused on driving up U.S. auto exports, then the car companies that operate here need to make EVs that can compete globally. And that’s where failing to make moves to incentivize an American battery sector as a matter of industrial policy, as China and South Korea have done, may come with steep price in the end.

“For us to put our head in the sand and say ‘We’re going to make the best internal combustion engines, we’re going to revert back,’ I just think we’re putting ourselves in a very bad place,” Lee said.

Contact the author: patrick.george@insideevs.com