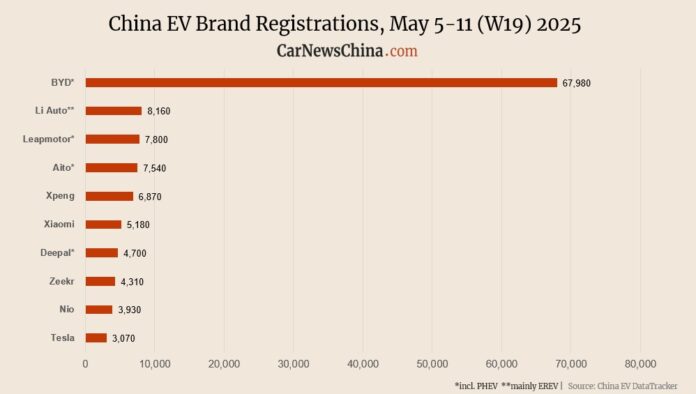

The first whole week of May was mainly up on the China EV market, with several exceptions. Nio was up 13%, Xpeng was up 24%, and BYD was up 15%, while Tesla was down 58% compared with the week before. Nio Group registered 6,060 cars, up 18.2% from the week before.

The weekly sales were published by Li Auto. However, Li Auto ceased publishing them in March 2025 after the China Association of Automobile Manufacturers (CAAM) “recommended” that Li Auto, media and any third parties end it. CAAM says weekly data “undermines the industry order” and “fuels vicious competition.” Since then, Li Auto has published only its own weekly EV registration.

The weekly data are used by consultants, analysts, or investors to see the sales trend and forecast monthly deliveries. They show how many cars were registered for road traffic, which can be later compared with automakers’ self-reported monthly sales, which, unlike registrations, include cars for showrooms, test cars, and other uses.

Most of China’s media have followed CAAM’s recommendation to stop publishing weekly figures. CarNewsChina continues to publish weekly insurance registrations, based on China EV DataTracker data.

The numbers are rounded and present new energy vehicle (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

Week 19 of 2025 (W19) was between May 5 and 11.

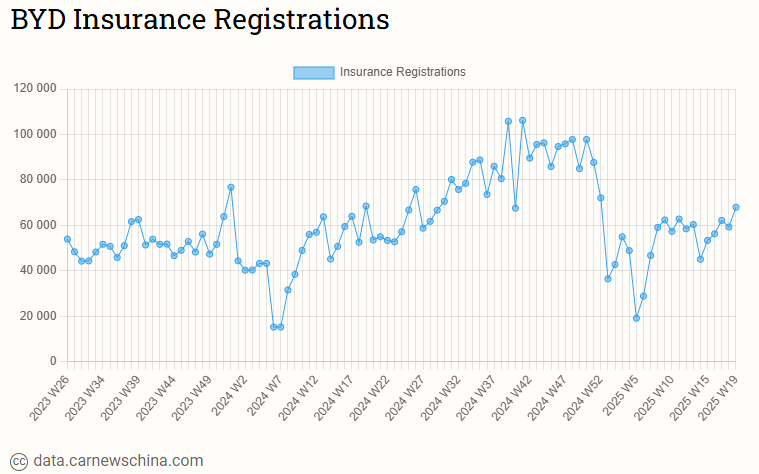

BYD registered 67,980 vehicles, up 14.6% from 59,310 units the week before. It is the best week in 2025 for the Shenzhen-based automaker so far.

BYD’s premium brand Denza registered 2,990 vehicles, up 3.8% from 2,880 units the week before.

BYD’s off-road brand Fang Cheng Bao registered 2,660 vehicles, up 17.7% from 2,260 units the week before.

BYD sold 372,615 passenger vehicles in April, nearly the same as in March and up 19.4% from April last year. It was a record-breaking month in 2025 for BYD.

BYD is expected to sell 5.5 million cars in 2025. The company sells only electric cars and plug-in hybrids (PHEVs), as it stopped producing ICE-only vehicles in April 2022.

Li Auto registered 8,160 vehicles, down 28.4% from 11,400 units the week before.

Li Auto sold 33,939 vehicles in April, down 7.5% from March and up 31.6% year-on-year.

Li Auto sells mainly EREV SUVs. Last year, it launched its first all-electric car, Li Mega. However, the sales were disastrous for the coffin-like vehicle. In response, Li Auto delayed the launch of another all-electric model to Q2 2025 – it will be an all-electric SUV, Li Auto i8.

Li Auto reportedly aims to sell 700,000 cars in 2025. In 2024, the company sold 500,508 vehicles.

Stellantis-backed Leapmotor registered 7,800 vehicles, up 25.8% from 6,200 units the week before.

Aito registered 7,540 vehicles, up 12.5% from 6,700 units the week before.

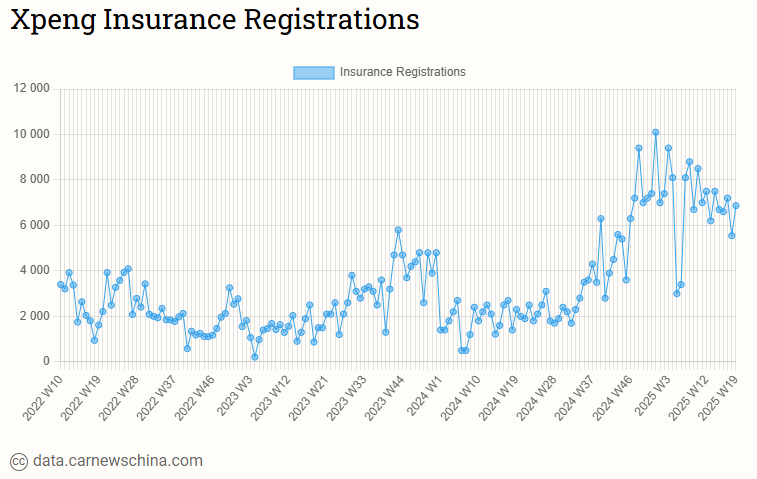

Volkswagen-backed Xpeng registered 6,870 vehicles, up 23.8% from 5,550 units the week before.

Xpeng sold 35,045 vehicles globally in April, up 5.5% from March and up 273% year-on-year.

Xpeng’s monthly delivery volume has exceeded 30,000 vehicles for the sixth consecutive month. The Mona M03 entry-level sedan has powered its deliveries. However, Xpeng surprisingly didn’t disclose Mona sales numbers for April.

Xpeng recently entered Italy in its European push.

Xiaomi registered 5,180 vehicles, down 9.1% from 5,700 units the week before.

Xiaomi sells a single car – Xiaomi SU7 sedan. It has three basic trims and one performance version, SU7 Ultra with over 1,500 hp. Its second car, the YU7 SUV, will launch around July. Beijing-based smartphone giant raised its 2025 delivery target by 50,000 units to 350,000 vehicles in March. Xiaomi delivered over 135,000 cars in 2024.

Deepal registered 4,700 vehicles, up 9.3% from 4,300 units the week before.

Zeekr registered 4,310 vehicles, up 39.0% from 3,100 units the week before.

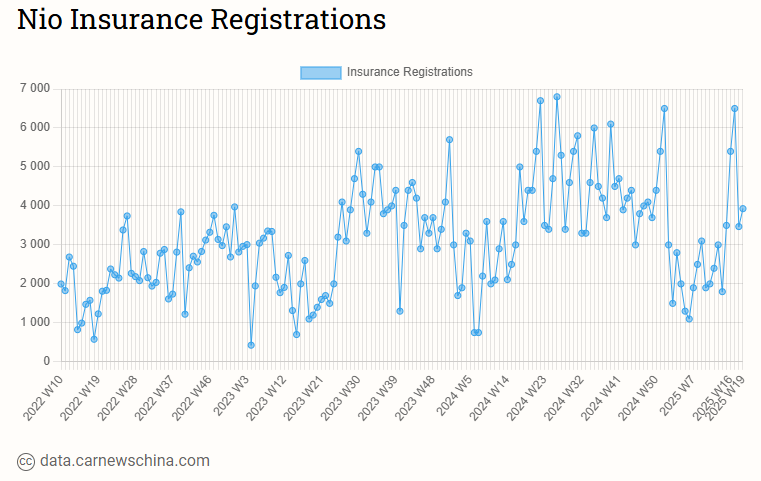

Nio registered 3,930 vehicles, up 13.3% from 3,470 units the week before.

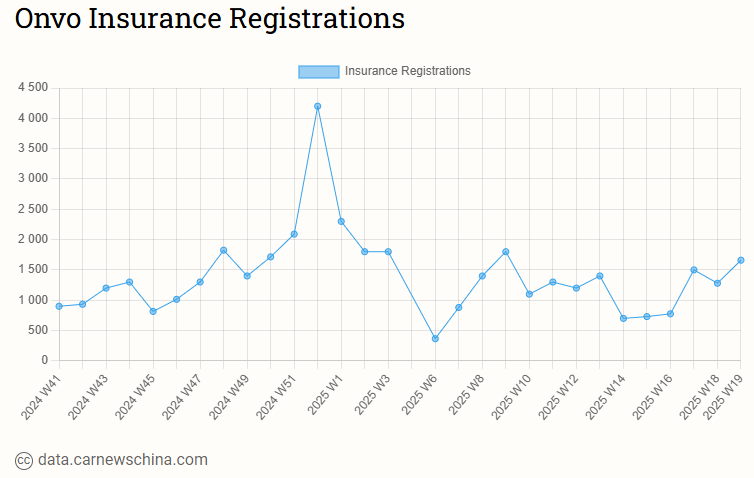

Onvo registered 1,660 vehicles, up 29.7% from 1,280 units the week before. It is the best result in the last ten weeks.

Firefly registered 470 vehicles, up 34.3% from 350 units the week before. This is the second week of ongoing registration for Firefly, as deliveries just started.

In total, Nio Group registered 6,060 cars in China, up 18.2% from 5,100 the week before.

In April, Nio Group sold 23,900 vehicles globally, up 58.9% from March and 53% year-on-year. This included 4,400 cars sold by the Onvo brand and 231 by Frefly. Onvo was 9% down in April compared with March.

Nio Group’s sales target is about 440,000 vehicles in 2025 of which Onvo should contribute half. Last year, the company delivered 220,000 vehicles.

Nio’s third brand launched its first EV, Firefly, on April 19. Yes, the brand’s name is Firefly, and the name of the EV is also Firefly. The small electric hatchback starts at 125,800 yuan (16,770 USD) with a battery.

Firefly supports battery swap. However, it can’t swap batteries currently as there are no compatible swap stations. The container swap stations dedicated to Firefly were scrapped, and the fifth-generation swap station, which should support the Nio brand, Onvo, and Firefly, will launch next year with limited availability.

Firefly will launch between June and August in Europe.

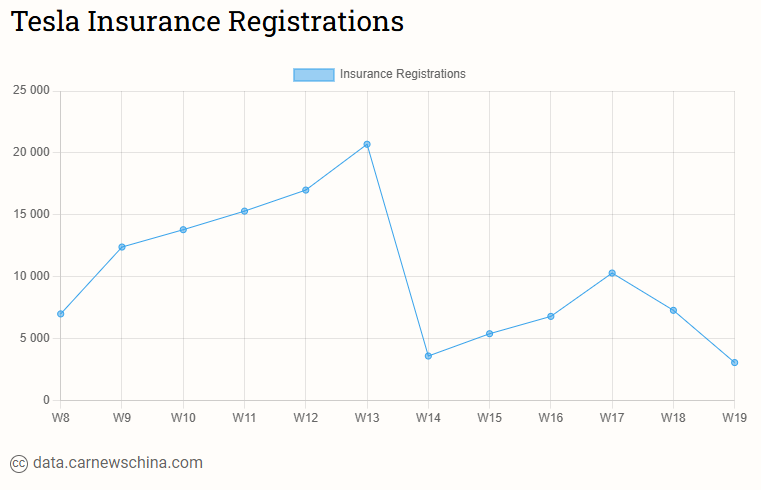

Tesla registered 3,070 vehicles, down 57.9% from 7,290 units the week before.

Tesla sales in China were down 9% to 28,731 in April, while the BEV market was 38% up.

Avatr registered 2,630 vehicles, up 25.2% from 2,100 units the week before.

Recommended for you

China EV registrations in week 18: Nio 3,500, Xpeng 5,500, Tesla 7,300, BYD 59,310

China EV registrations in week 17: Nio 6,500, Xiaomi 7,000, Tesla 10,300, BYD 62,200

China EV registrations in week 16: Nio 5,400, Tesla 6,800, Xiaomi 7,200, BYD 56,300