BYD has strongly refuted recent allegations comparing it to Evergrande, the embattled Chinese real estate giant. Li Yunfei, General Manager of BYD’s Brand and Public Relations Division, addressed the claims in a lengthy statement on May 30, 2025, expressing both confusion and frustration over what he described as “malicious smear campaigns.”

The controversy stems from remarks made last week by Wei Jianjun, Chairman of Great Wall Motor, who suggested that an “Evergrande of the auto industry” already exists, though it has yet to “explode.”

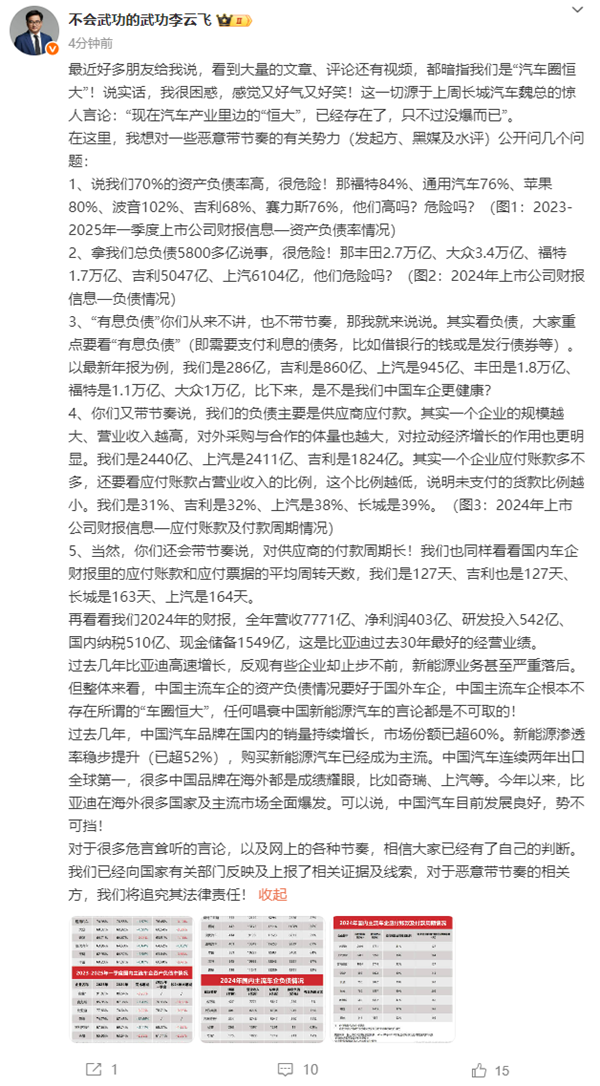

Li Yunfei directly challenged the accusations by presenting comparative financial data from various global and domestic automakers.

Addressing Key Financial Concerns:

- Asset-Liability Ratio: Critics have pointed to BYD’s 70% asset-liability ratio as a sign of high risk. However, Li highlighted that Ford (84%), General Motors (76%), Apple (80%), and Boeing (102%) all have higher ratios. Domestically, Geely stands at 68% and Seres at 76%.

- Total Debt: Concerns were raised over BYD’s total debt of over 580 billion yuan. Li countered by noting that Toyota’s debt is 2.7 trillion yuan, Volkswagen’s is 3.4 trillion yuan, and Ford’s is 1.7 trillion yuan. Among Chinese automakers, SAIC has 610.4 billion yuan and Geely has 504.7 billion yuan in debt.

- Interest-Bearing Debt: Li emphasised the importance of interest-bearing debt, which represents borrowings that incur interest, such as bank loans or bonds. He stated that BYD’s interest-bearing debt is 28.6 billion yuan, significantly lower than Geely’s 86 billion yuan, SAIC’s 94.5 billion yuan, Toyota’s 1.8 trillion yuan, Ford’s 1.1 trillion yuan, and Volkswagen’s 1 trillion yuan. This, he argued, indicates a healthier financial position for BYD and other Chinese automakers.

- Accounts Payable: Regarding claims that BYD’s debt is primarily due to supplier payables, Li explained that larger companies with higher revenues naturally have larger procurement volumes. He noted BYD’s accounts payable at 244 billion yuan, comparable to SAIC’s 241.1 billion yuan and Geely’s 182.4 billion yuan. Furthermore, BYD’s accounts payable as a percentage of operating revenue is 31%, lower than Geely (32%), SAIC (38%), and Great Wall (39%).

- Supplier Payment Cycle: Li also addressed concerns about long supplier payment cycles. He stated that BYD’s average turnover days for accounts payable and notes payable is 127 days, identical to Geely’s 127 days, and shorter than Great Wall’s 163 days and SAIC’s 164 days.

Li highlighted BYD’s 2024 financial report, which showed full-year revenue of 777.1 billion yuan, net profit of 40.3 billion yuan, R&D investment of 54.2 billion yuan, domestic tax contributions of 51 billion yuan, and cash reserves of 154.9 billion yuan. He described this as BYD’s best operating performance in 30 years.

Li asserted that mainstream Chinese automakers’ overall financial health is superior to that of their foreign counterparts and that there is no “Evergrande of the auto industry” within China. He condemned any rhetoric aimed at undermining the Chinese new energy vehicle sector.

He further emphasised the robust growth of Chinese automotive brands, which now command over 60% of the domestic market share. The penetration rate of new energy vehicles has exceeded 52%, making them a mainstream choice. China has also been the world’s largest auto exporter for two consecutive years, with many Chinese brands, including BYD, Chery, and SAIC, achieving significant success overseas.

BYD has reported a comprehensive surge in overseas markets this year, indicating the strong and unstoppable development of the Chinese automotive industry.

Li concluded by stating that BYD has reported relevant evidence to the national authorities and will pursue legal action against parties involved in malicious smear campaigns.

Note: 1 Chinese yuan is approximately equal to 0.139 US dollars.