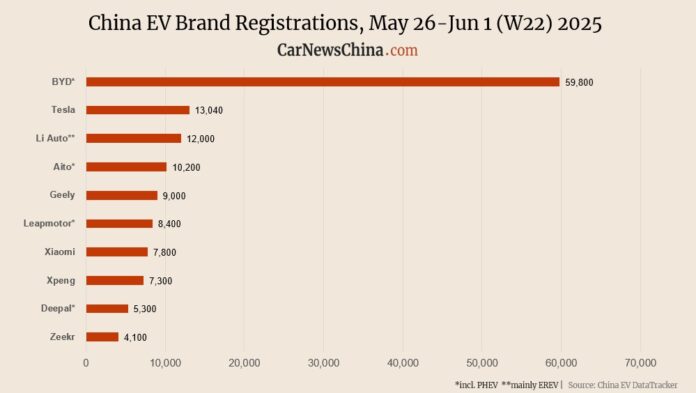

The China EV market was mainly up in the last week of May, with Nio Group being an exception. Xiaomi was up 14%, Tesla was up 19%, and BYD was up 12% compared with the previous week. Nio was down 22%, Onvo 10% and Firefly 12%.

Key events to watch

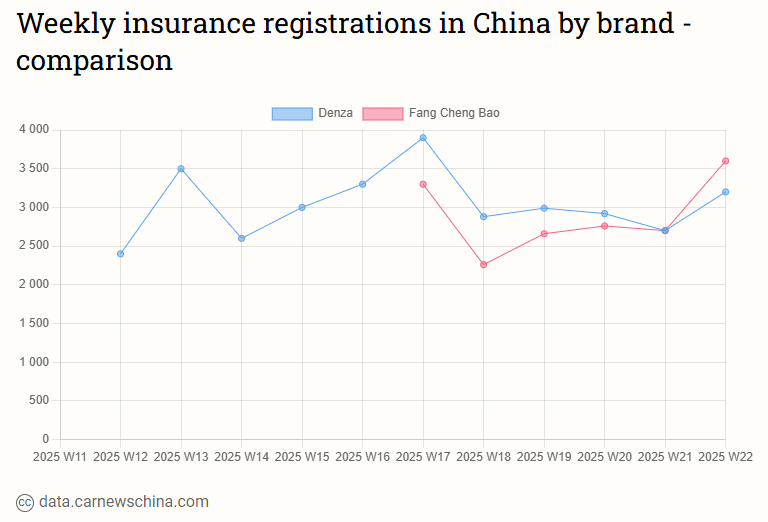

- BYD’s new brand Fang Cheng Bao outsold Denza for the first time

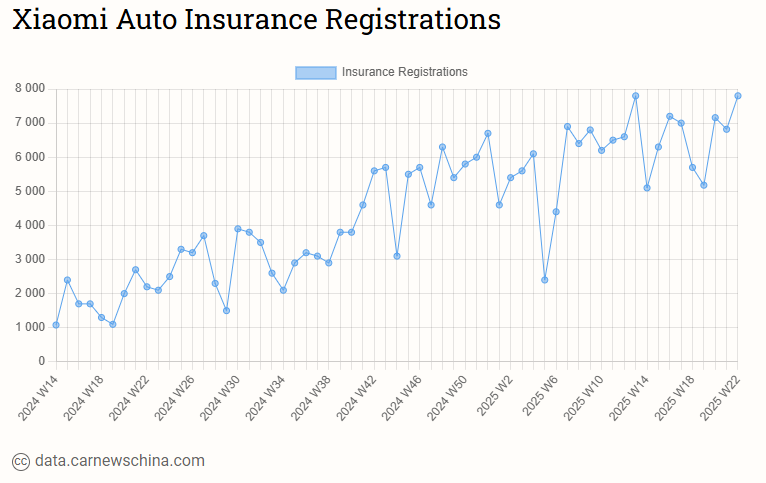

- Xiaomi topped its all-time high from week 13 with 7,800 sold cars and 254.5% year-on-year growth

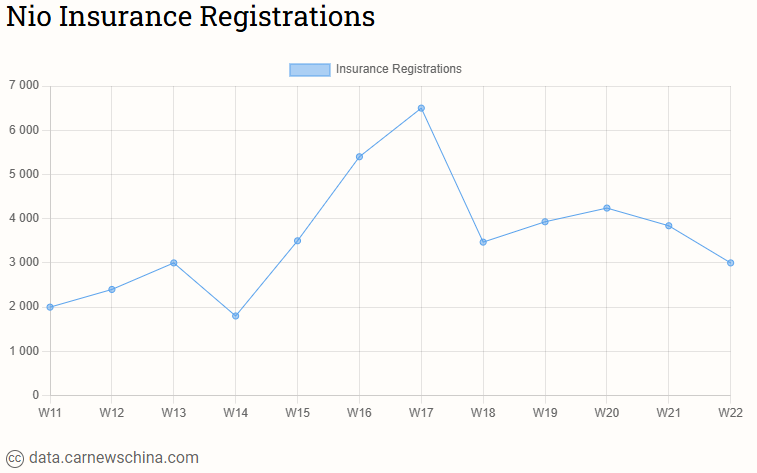

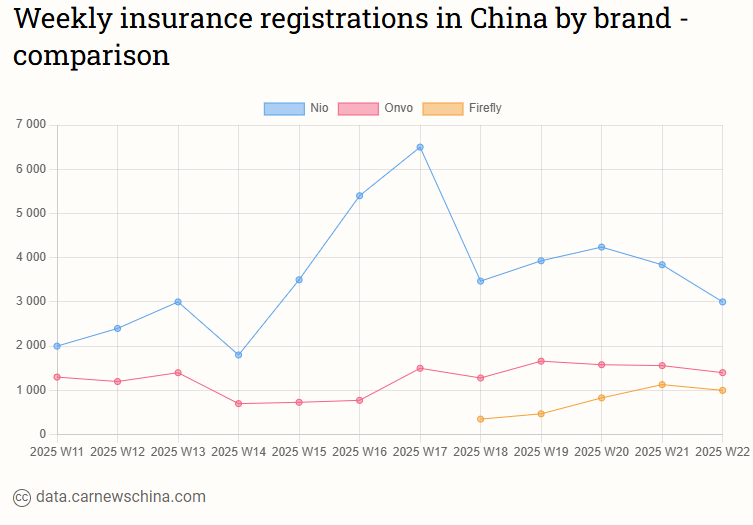

- Nio Group was the only EV maker down in week 22 of the year, with all its subrands also down

- Nio Group sold 5,400 cars, down 17.3% from last week.

- Nio 3,000

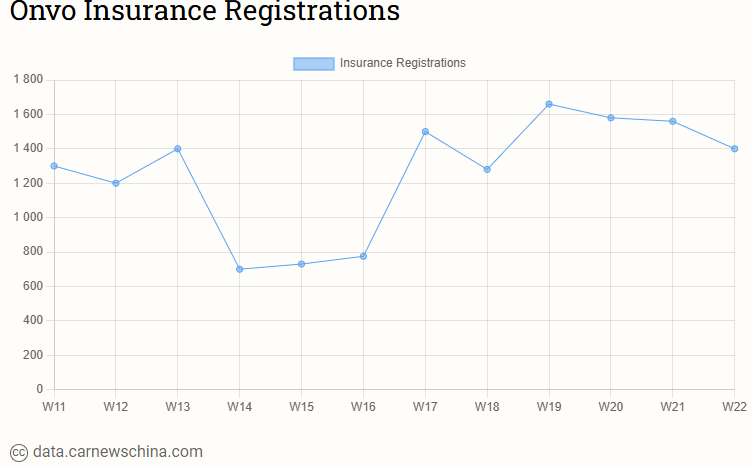

- Onvo: 1,400

- Firefly 1,000

- Li Auto had its best week in 2025, asserting dominance among EV startups after a back-and-forth sales fight for the top spot between Leapmotor, Xpeng and Li Auto around week 17 in April

The weekly sales were published by Li Auto. However, Li Auto ceased publishing them in March 2025 after the China Association of Automobile Manufacturers (CAAM) “recommended” that Li Auto, media and any third parties end it. CAAM says weekly data “undermines the industry order” and “fuels vicious competition.” Since then, Li Auto has published only its own weekly EV registration.

The weekly data are used by consultants, analysts, or investors to see the sales trend and forecast monthly deliveries. They show how many cars were registered for road traffic, which can be later compared with automakers’ self-reported monthly sales, which, unlike registrations, include cars for showrooms, test cars, and other uses.

Most of China’s media have followed CAAM’s recommendation to stop publishing weekly figures. CarNewsChina continues to publish weekly insurance registrations, based on China EV DataTracker data.

The numbers are rounded and present new energy vehicle (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

Week 22 of 2025 (W22) was between May 26 and June 1.

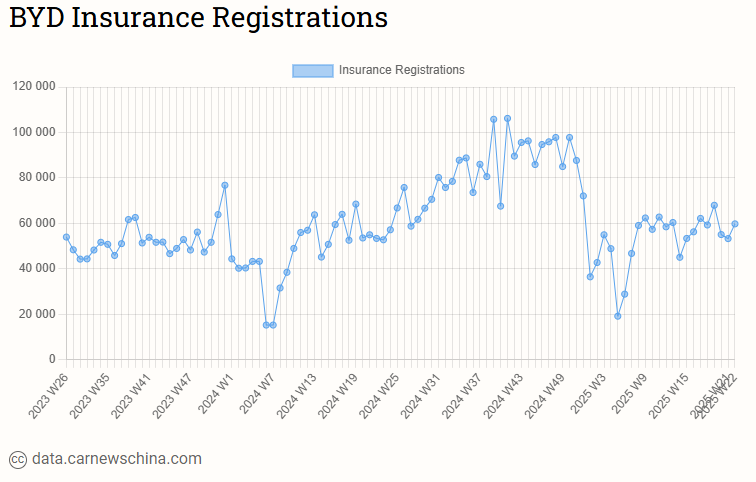

BYD registered 59,800 vehicles, up 12.2% from 53,320 units the week before, and rose 11.99% from 53,400 units in the same week last year. In the first four weeks of May, BYD registered 236,200 vehicles in China.

Fang Cheng Bao registered 3,600 vehicles, up 33.3% from 2,700 units the week before. No comparable year-over-year data is available. In the first four weeks of May, Fang Cheng Bao registered 11,720 vehicles in China.

Denza registered 3,200 vehicles, up 18.5% from 2,700 units the week before, and rose 28.00% from 2,500 units in the same week last year. In the first four weeks of May, Denza registered 11,810 vehicles in China.

In May, BYD sold 382,476 vehicles, up 15.3% from the same month last year.

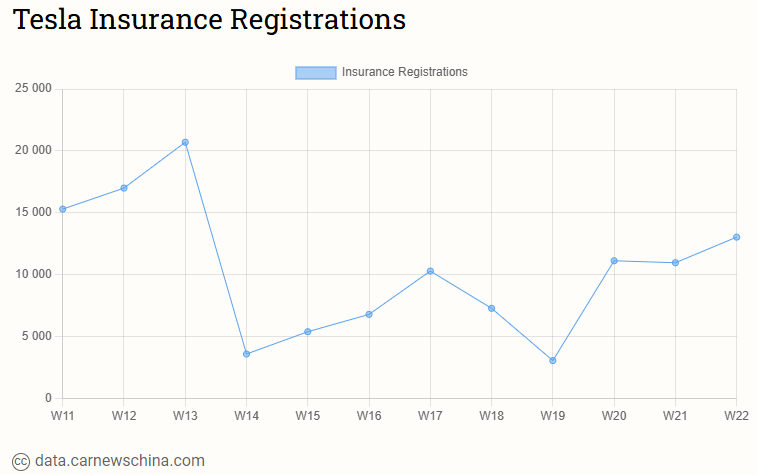

Tesla registered 13,040 vehicles, up 18.9% from 10,970 units the week before, but fell 14.21% from 15,200 units in the same week last year. In the first four weeks of May, Tesla registered 38,210 vehicles in China.

Li Auto registered 12,000 vehicles, up 14.6% from 10,475 units the week before, and rose 42.86% from 8,400 units in the same week last year. In the first four weeks of May, Li Auto registered 39,875 vehicles in China.

Aito registered 10,200 vehicles, up 16.2% from 8,778 units the week before, and rose 45.71% from 7,000 units in the same week last year. In the first four weeks of May, Aito registered 34,008 vehicles in China.

Geely registered 9,000 vehicles. There is no prior week or year-over-year data available for comparison.

Leapmotor registered 8,400 vehicles, up 16.9% from 7,185 units the week before, and rose 95.35% from 4,300 units in the same week last year. In the first four weeks of May, Leapmotor registered 30,885 vehicles in China.

In May, Leapmotor delivered record-breaking 45,067 cars, surpassing its previous all-time high from December 2024. The May deliveries are up 148% from the same month last year.

Xiaomi registered 7,800 vehicles, up 14.4% from 6,819 units the week before, and surged 254.55% from 2,200 units in the same week last year. In the first four weeks of May, Xiaomi registered 26,959 vehicles in China.

Xpeng registered 7,300 vehicles, up 28.1% from 5,700 units the week before, and rose 192.00% from 2,500 units in the same week last year. In the first four weeks of May, Xpeng registered 25,680 vehicles in China.

Xpoeng delivered 33,525 cars in May, the seventh consecutive month exceeding the 30,000 threshold. It also represents 230% growth from May 2024, when it delivered 10,146 units.

Deepal registered 5,300 vehicles, up 17.3% from 4,520 units the week before, and rose 96.30% from 2,700 units in the same week last year. In the first four weeks of May, Deepal registered 19,020 vehicles in China.

Zeekr registered 4,100 vehicles, up 13.9% from 3,600 units the week before, but fell 2.38% from 4,200 units in the same week last year. In the first four weeks of May, Zeekr registered 15,650 vehicles in China.

Nio registered 3,000 vehicles, down 21.9% from 3,840 units the week before, and fell 55.22% from 6,700 units in the same week last year. In the first four weeks of May, Nio registered 15,010 vehicles in China.

Onvo registered 1,400 vehicles, down 10.3% from 1,560 units the week before. No comparable year-over-year data is available. In the first four weeks of May, Onvo registered 6,200 vehicles in China.

Firefly registered 1,000 vehicles, down 11.5% from 1,130 units the week before. No comparable year-over-year data is available. In the first four weeks of May, Firefly registered 3,430 vehicles in China.

Nio Group delivered 23,231 cars in May, up 13% from 20,544 units in the same month last year and down 2.8% from 23,900 units in April.

- Nio brand delivered 13,270 cars in May, down 35.4% year-on-year

- Onvo delivered 6,281 cars in May, up 42.8% from April

- Firefly delivered 3,680 vehicles in May; no comparisons are available as deliveries started at the end of April

Avatr registered 2,400 vehicles, down 2.8% from 2,470 units the week before. No comparable year-over-year data is available. In the first four weeks of May, Avatr registered 9,900 vehicles in China.

Recommended for you

China EV registrations in week 21: Nio 3,840, Xpeng 5,700, Tesla 10,970, BYD 53,320

China EV registrations in week 20: Nio 4,240, Xiaomi 7,160, Tesla 11,130, BYD 55,100

China EV registrations in week 19: Tesla 3,070, Nio 3,930, Xpeng 6,870, BYD 67,980