Ford (F) released its second-quarter earnings on Wednesday. Although Ford beat top-line expectations with revenue up 6%, it missed Q2 2024 earnings expectations by a wide margin.

Ford Q2 2024 earnings preview

After EV sales surged 61% year-over-year in Q2 2024, Ford remained the second best-selling EV maker in the US behind Tesla.

With nearly 23,957 EVs sold in the second quarter, Ford topped rival GM, which sold 21,930 electric models. All Ford EV models had double-digit YOY growth.

F-150 Lightning sales rose 77%, with 7,902 sold. Ford sold 12,645 Mustang Mach-E’s, up 46.5%. Meanwhile, sales of Ford’s electric van, the E-Transit, surged 95.5%, with 3,410 models sold in Q2.

Despite the progress, Ford has pulled back on several EV initiatives. The American automaker has cut F-150 Lightning production, delayed around $12 billion in EV spending, and most recently announced plans to build more Super Duty trucks at its EV plant in Ontario.

Ford has said the adjustments are due to “slower-than-expected” demand. Meanwhile, like rival GM, Ford will lean more toward hybrids. Ford’s hybrid sales also picked up in Q2, rising 55.6%.

After Ford’s new F-150 was delayed, F-series pickup sales fell 6%. Ford’s Ranger, Maverick, and Expedition led a recovery in truck sales (+4.5%).

Although Ford is projected to post Q2 2024 earnings growth, it’s not expected to be as strong as rival GM. According to Earnings Whispers, Ford is expected to post Q2 EPS of $0.64 with revenue of $41.65 billion.

Financial results

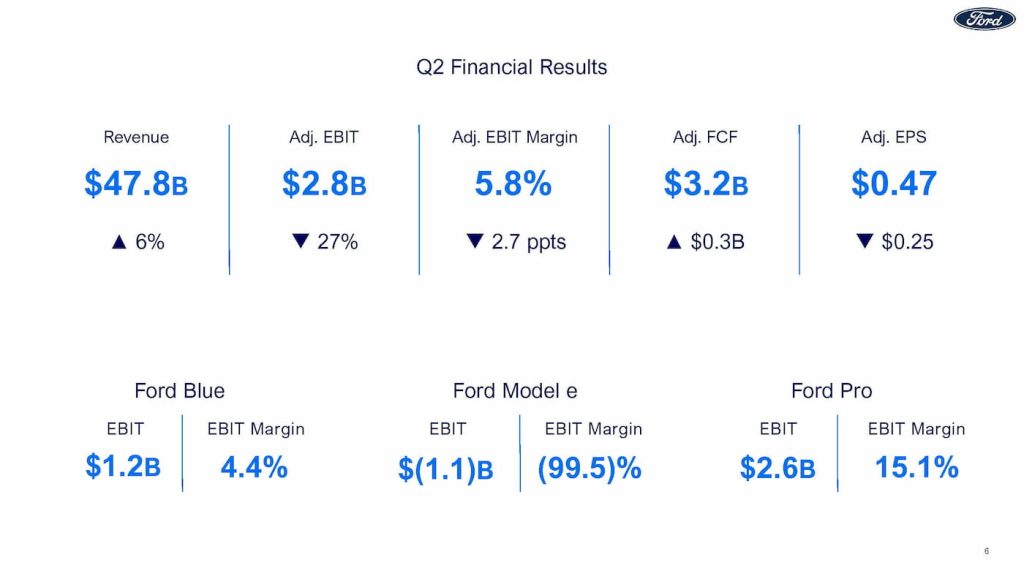

Ford posted Q2 2024 auto revenue of $44.8 billion, up 6% and beating projections. Overall revenue, including Ford’s finance unit, reached $47.81 billion. Meanwhile, net income was $1.8 billion, or $0.47 per share.

- Revenue: $44.8 billion vs $41.65 billion expected

- EPS: $0.47 vs $0.64 expected

With EBIT slipping 27% YOY to $2.67 billion, or 0.47 cents per share, Ford missed expectations by a wide margin.

Ford Pro, its commercial and software unit, remained the main growth driver, with revenue climbing 9% to $17 billion. The unit posted a strong EBIT margin at 15.1% with Q2 EBIT of $2.6 billion.

According to Ford, its Pro business is profitable in every region it operates. Ford Pro software subscriptions were up 35% in the quarter, while mobile repair orders more than doubled.

Ford’s CEO Jim Farley said it’s common for commercial customers to adopt new tech, including connected and EVs, before individuals.

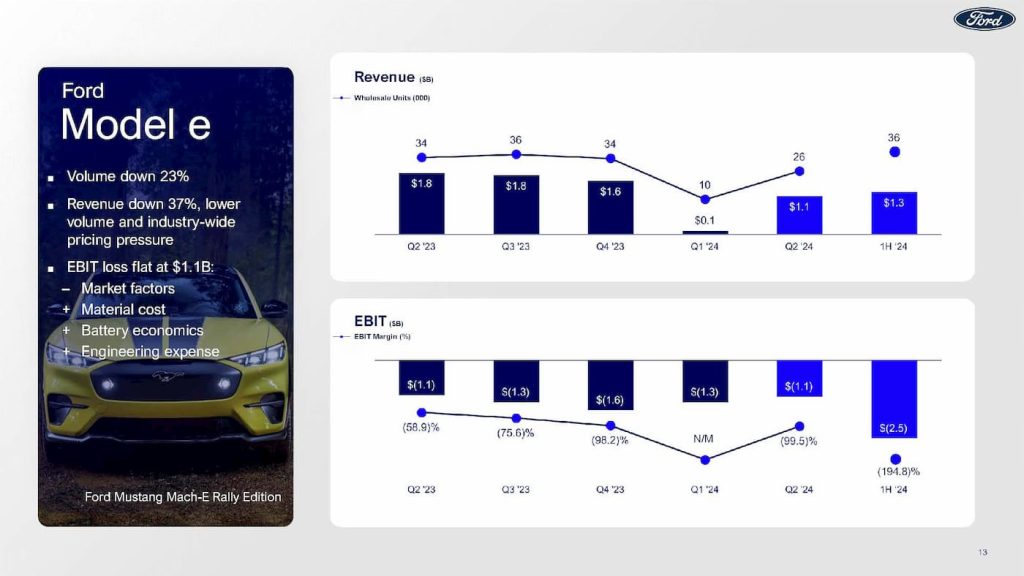

Speaking of EVs, Ford’s model e unit lost another $1.1 billion in the second quarter. Ford Model e revenue fell to $1.3 billion, while volume was down 23% in Q2.

Ford’s EV losses are reached $2.5 billion through the first half of 2024. The higher losses are due to lower volume and “industry-wide pricing pressure.”

Ford Blue, the company’s ICE business, saw volume and revenue rise 3% and 7%, respectively.

Full-year EBIT guidance remains unchanged at $10 to $12 billion. Meanwhile, Ford raised adjusted FCF expectations by $1 billion ($7.5 to $8.5 billion).

Ford still expects its Model e EV business to lose between $5.0 to $5.5 billion this year. The company said continued pricing pressure and investments in next-gen EVs will contribute to the losses.

Ford’s stock is down over 11% after hours following its earnings release. Check back for more info from Ford’s Q2 2024 earnings call at 5 PM.

Update: On the company’s earnings call, Farley stressed that Ford is focusing on smaller, more profitable EVs. According to Farley, the main competition is Tesla and low-cost competitors from China.

Farley said the only way Ford can compete with BYD and others is through its new platform, which is being developed by a “skunkworks” team in Long Beach.

The platform is central to Ford’s “more realistic and sharpened” EV plan to drive profits. Farley said the company will not release unprofitable EVs as the company works toward break even. Ford’s electric van is already profitable, according to Farley.

Farley said Ford’s desire to partner on EVs is at an all-time high. Although he didn’t offer any details, he said to expect more soon.

Ford is betting on small EVs, software, and its commercial business to drive growth. Farley noted software and subscriptions can help maintain growth if the economy turns.