The collapse of Jiyue Auto is obviously the biggest automotive story of the week in China. It is the second high-profile company to go bust in the Chinese car market in 2024 following the collapse of HiPhi and its parent company, Human Horizons, earlier this year. They are not the first such companies to fail in China and undoubtedly will not be the last.

What, though, will be the fallout from these collapses, and will there be any long-lasting impact? For the buyers of cars from such companies, there is a long-term question mark about not only the ability to use the cars but also maintaining them in the future. This has a huge impact on the second-hand resale value.

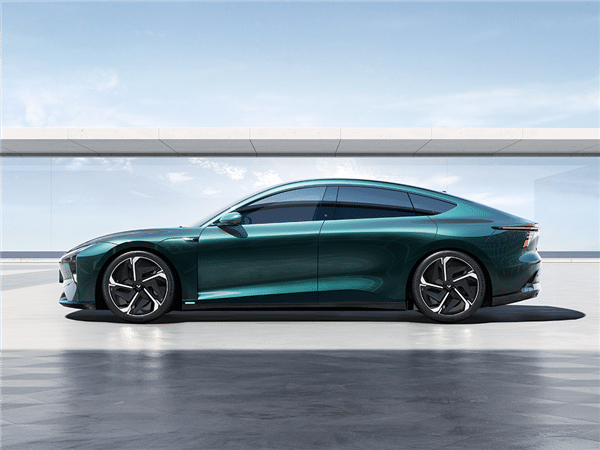

On December 13, the car blogger Han Lu posted on Weibo that he had bought a Jiyue 07 for 230,000 yuan (31,600 USD) last month. However, today, when he went around second-hand car dealers asking how much they would give him for the car, most rejected him outright, and he only received one offer of 20,000 yuan (2750 USD).

Han Lu angrily responded that he’d rather dismantle the car and sell it as spare parts to owners. However, with reportedly 70% of the parts for the Jiyue models coming from Geely, there might not be a big problem with maintaining the cars in the future.

Such a drop may be simply due to the large amount of uncertainty currently facing Jiyue Auto. Fast Technology reported on December 13 that a 2021 model year HiPhi X founders edition with 27,000 kilometers was valued at 200,000 yuan (27,500 USD). The car was originally purchased for 680,000 yuan (93,500 USD), which means a loss of around 200,000 yuan (27,500 USD) a year.

By comparison, a 2022 BMW X5 xDrive 30Li, which retailed for a similar 639,000 yuan (87,850 USD) and with mileage of 29,000 kilometers, was valued at 400,000 yuan (55,000 USD). This clearly shows that the owners of cars whose producers have gone bust suffer large financial losses.

Could such losses deter people from buying cars from other new entrant brands? Certainly, this may well be the case in the short term. The brand at most risk is likely Neta. With sales already significantly down and rumors swirling around the company, potential buyers may well stay away because of fear about the company going bust, thus becoming a self-fulfilling prophecy.

Even for larger startups like Nio and Xpeng, there is still a great deal of uncertainty over their long-term viability. Although the losses per car from each are reducing, both brands need to be able to show higher and more consistent sales.

If a brand that was largely owned by two heavyweights, Geely and Baidu, can fail, it leaves a large degree of uncertainty in the market. What is not helping the situation is the ongoing price war, which pushes producers to sacrifice profits in order to gain volume.

As we have reported, many of the OEMs are pressuring suppliers to reduce prices. This creates an added strain on the whole supply chain. With very thin margins, any OEM that collapses owing money to a supplier may lead to a domino effect among suppliers.

2025 could turn out to be a year of significant realignment in the Chinese car market.

Source: Fast Technology