In the first week of December, the China EV market was mostly up, with several exceptions. Nio grew 19%, Xiaomi grew 7%, Tesla was down 16%, and BYD was up 15% from the previous week. Nio’s brand Onvo registered 1,715 units, up 23% from the previous week.

Week 50 (W50) of the year was between December 5 and December 15. Week 50 of 2023, used for year-on-year comparison, was between December 11 and December 17.

The weekly sales are published by Li Auto, and despite Li’s not explicitly saying it, they are based on insurance registration data. The numbers are rounded and present new energy vehicles (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China. Onvo registrations are not published by Li Auto but come from China EV DataTracker.

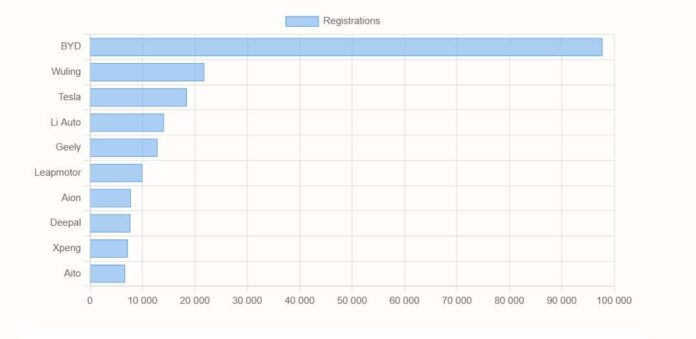

BYD maintained its lead with 97,800 registrations, reflecting a 15.1% increase from the previous week and an impressive 89.2% rise year-over-year.

Wuling recorded 21,800 registrations, a slight week-over-week increase of 1.9% and a solid 83.2% growth compared to the same period last year.

Tesla registered 18,500 units, a 15.5% decline from last week, though year-over-year registrations showed a modest increase of 1.1%.

Li Auto achieved 14,100 registrations, up 11.9% week-over-week and 24.8% compared to last year.

Geely saw 12,900 registrations, a significant 72.0% increase from the previous week. Year-over-year data is unavailable for comparison.

Leapmotor registered 10,000 units, reflecting a 17.6% week-over-week increase and a remarkable 150.0% growth compared to last year.

Aion recorded 7,800 registrations, up 13.0% from last week, though year-over-year registrations declined by 10.3%.

Deepal registered 7,700 units, marking a 13.2% increase week-over-week and a strong 148.4% rise year-over-year.

Xpeng achieved 7,200 registrations, a 2.9% increase from the previous week and a 50.0% rise compared to last year.

Aito reported 6,700 registrations, an 11.7% week-over-week increase.

Xiaomi Auto registered 5,800 units, reflecting a 7.4% increase from last week.

Xiaomi launched its only car, SU7 sedan, on March 28, with deliveries starting a few days later. Xiaomi surpassed 100,000 delivered units in November with an annual target of 130,000.

Zeekr recorded 5,200 registrations, down 3.7% week-over-week but showing a 136.4% increase year-over-year.

Nio brand registered 4,400 vehicles, an 18.9% increase from the previous week and a 29.4% rise year-over-year. As insurance registrations represent only brands, Onvo registration numbers are not included in Nio numbers.

In the first two weeks of December (Dec 2-15), Nio brand registered 8,100 cars in China

Onvo registered 1,715 units, up 22.5% from 1,400 in the previous week. Onvo launched its only model L60 SUV on September 19 in China, with deliveries starting on September 28.

Onvo’s president, Alan Ai, recently reiterated the goal of delivering 10,000 Onvo L60 in December. In the first two weeks of December (Dec 2-15), Onvo registered 3,115 cars in China.

Nio’s group (Nio+ Onvo) registrations in the first two weeks of December are 11,215 units. Nio’s group delivery target for December is 30,449 based on fourth-quarter guidance.

Luxeed saw 3,400 registrations, up 3.0% week-over-week. No year-over-year data is available.

Denza recorded 3,200 units. Week-over-week data is unavailable, but registrations increased by 14.3% year-over-year.