According to a credible new report, Elon Musk has reportedly shut down an internal analysis from Tesla executives that showed the company’s Robotaxi plans would lose money and that it should focus on its more affordable ‘Model 2’.

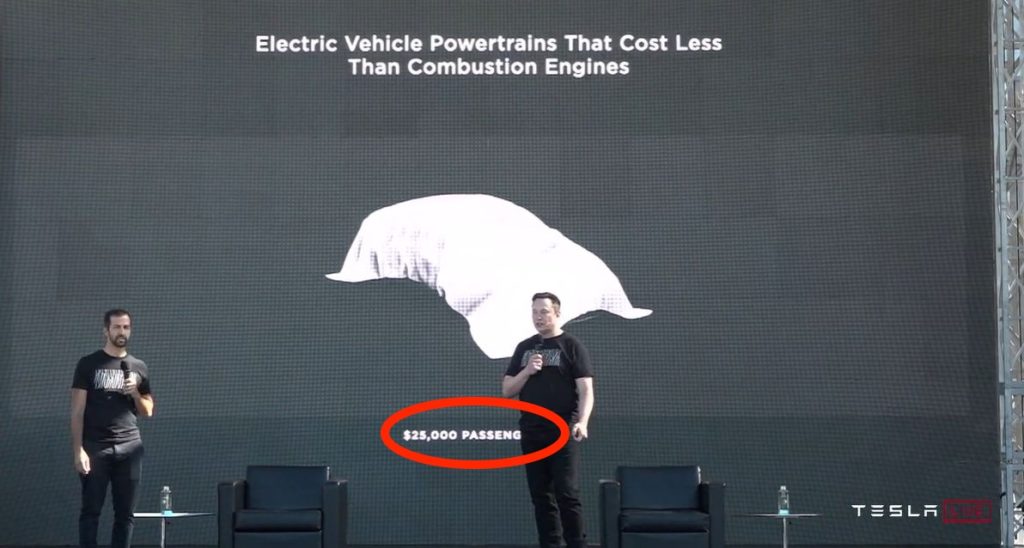

In early 2024, we reported that Musk had canceled Tesla’s plan for a new affordable electric vehicle built on its upcoming ‘unboxed’ vehicle platform, often referred to as ‘Model 2’ or ‘$25,000 Tesla’.

Instead, Musk pushed for only its new Robotaxi, also known as Cybercab, to be built on the new platform, and replaced the plans for a next-gen affordable EV with building cheaper versions of the Model Y and Model 3 with fewer features.

This decision culminated a long-in-the-making shift at Tesla from an EV automaker to an AI company focusing on self-driving cars.

We credit that shift initiated by Musk for the current slump Tesla finds itself in right now, where it has only launched a single new vehicle in the last 5 years, the Cybertruck, and it’s a total commercial flop.

Now, The Information is out with a new in-depth report based on Tesla insiders that describe the decision-making process around the cancellation of the affordable Tesla and the focus on Robotaxi.

The report describes a meeting at the end of February 2024 when several Tesla executives were pushing Musk to greenlight the $25,000 Tesla:

In the last week of February 2024, after a couple of years of back-and-forth debate on the Model 2, Musk called a meeting of a wide range of executives at Tesla’s offices in Palo Alto, Calif. The proposed $25,000 car was on the agenda—a final chance to air the vehicle’s pros and cons, the people said. Musk’s senior lieutenants argued intensely for the economic logic of producing both the Model 2 and the Robotaxi.

After unveiling its next-generation battery in 2020, Musk announced that Tesla would make a $25,000 EV in 2020, but he had clearly soured on the idea by 2024.

He said in October 2024:

I think having a regular $25,000 model is pointless. Yeah. It would be silly. Like, it’ll be completely at odds with what we believe.

The Information says that Daniel Ho, head of Tesla vehicle programs, Drew Baglino, SVP of engineering, and Rohan Patel, head of business development and policy, Lars Moravy, vice president of vehicle engineering, and Franz von Holzhausen, chief designer, all pushed for Musk to greenlight the production of the new $25,000 model.

Omead Afshar, a Musk loyalist who started out as his chief of staff and now holds a wide-ranging executive role at Tesla, reportedly said, “Is there a mutiny?”

The executives pointed to an internal report that didn’t paint a good picture of Tesla’s Robotaxi plan. The report has credibility as Patel commented on it:

We had lots of modeling that showed the payback around FSD [Full Self Driving] and Robotaxi was going to be slow. It was going to be choppy. It was going to be very, very hard outside of the U.S., given the regulatory environment or lack of regulatory environment.

Musk dismissed the analysis, greenlighted the Cybercab, and killed the $25,000 driveable Tesla vehicle in favor of the Model Y-based cheaper vehicle with fewer features.

The information describes the analysis:

Much of the work was done by analysts working under Baglino, head of power train and one of Musk’s most trusted aides. The calculations began with some simple math and some broad assumptions: Individuals would buy the cars, but a large portion of the sales would go to fleet operators, and the vehicles would mostly be used for ride-sharing. Many people would give up car ownership and use Robotaxis. Tesla would get a cut of each Robotaxi ride.

The analysis followed a lot of Musk’s assumptions, such as that the US car fleet would shrink from 15 million a year to roughly 3 million due to Robotaxis having a 5 times higher utilization rate.

They subtracted people who wouldn’t want to switch to a robotaxi for various reasons, arriving at a potential for 1 million self-driving vehicles a year.

One of the people familiar with the analysis said:

There is ultimately a saturation of people who want to be ferried around in somebody else’s car.

After accounting for competition, Tesla figured it would be hard for robotaxis to replace the ~600,000 vehicles it sells in the US annually.

Tesla calculated that the robotaxis would bring in about $20,000 to $25,000 in revenue at the sale and about three times that from Tesla’s share of the fares it would complete over their lifetimes:

The analysts figured Robotaxis would sell for between $20,000 and $25,000, and that Tesla could make up to three times that over the lifetime of the cars through its cut of fares. They added in capital spending and operational costs, plus services like charging stations and parking depots.

The internal analysis assigned a much lower value to Tesla robotaxis than Musk had previously stated publicly.

In 2019, Musk said:

If we make all cars with FSD package self-driving, as planned, any such Tesla should be worth $100k to $200k, as utility increases from ~12 hours/week to ~60 hours/week.

Furthermore, Tesla’s internal analysis pointed toward difficulties expanding into other markets, which could limit the scale and profitability of the robotaxi program. Ultimately, it predicted that it could lose money for years.

Electrek’s Take

For years, this has been one of my biggest concerns about Tesla: Musk surrounding himself with yesmen and not listening to others.

This looks like a perfect example. It was a terrible decision fueled by Musk’s belief that he was smarter than anyone in the room and encouraged by sycophants like Afshar.

Musk has been selling Tesla shareholders on a perfect robotaxi future, but the truth is not as rosy, and that’s if they solve self-driving ahead of the competition, which is a big if.

It’s not new for the CEO to make outlandish growth promises, but it’s another thing to do at the detriment of an already profitable and fast-growing auto business.

The report also supports our suspicions that the shift in strategy contributed to some of Tesla’s talent exodus last year.